The Activision Deal… The Deal of the Century or the Biggest Mistake in Xbox History?

🎮 Was the Activision Deal Really in Microsoft’s Favor or a Potential Disaster?

In the past few years, Microsoft’s acquisition of Activision Blizzard has sparked huge debates among gamers and tech analysts. In this article, we’ll break down all aspects — the good and the bad — to answer one key question: was this deal a smart strategic move or a ticking time bomb?

📌 Quick Background: Microsoft, Game Pass, and the Pre-Deal Era

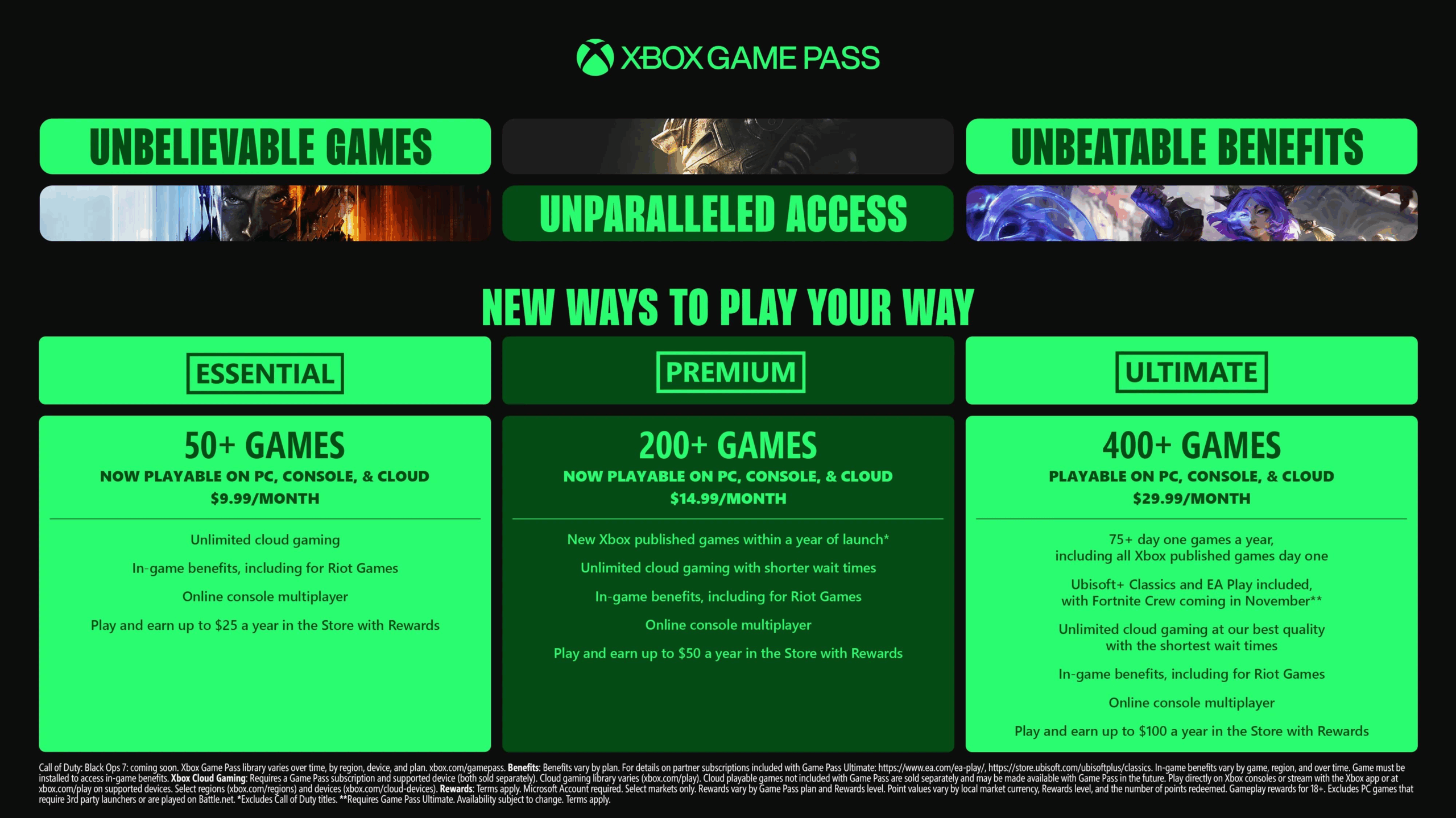

The Xbox Game Pass service launched in June 2017 as a subscription model granting access to a large game library for a monthly fee, gaining strong attention in the following years. Before acquiring Activision, Microsoft had already integrated titles from its own studios like Xbox Game Studios and Bethesda (after a separate acquisition), as well as partnerships with third-party developers.

Games from Microsoft’s studios were usually released as exclusives or semi-exclusives for Xbox and Windows platforms, strengthening the ecosystem and hardware sales.

In short, before the deal, Microsoft saw Game Pass as a way to attract players to its ecosystem and increase loyalty, not as an instant profit machine — as long as the service remained stable, affordable, and packed with great content.

🚀 What the Activision Deal Brought: The Potential Positives

When Microsoft announced its acquisition of Activision Blizzard on January 18, 2022, many viewed it as a massive strategic advantage:

- A massive library of iconic franchises: Activision owns huge IPs like Call of Duty, Overwatch, Diablo, and World of Warcraft. Having these under Microsoft’s umbrella meant the potential to add them to Game Pass and skyrocket its value.

- Boosting competitiveness: Adding blockbuster games to Game Pass made it incredibly appealing — players could enjoy AAA titles for a relatively low subscription fee.

- Studio and expertise integration: The acquisitions of Bethesda and Activision allowed Microsoft to consolidate vast development experience and diverse production technologies under one roof.

- Revenue model transformation: Instead of relying on individual game sales, the company could focus on a subscription-based model with steady, predictable income.

So, in theory, the Activision deal looked like a smart and powerful move — it strengthened Microsoft’s position in the subscription war and made Game Pass more tempting than ever.

⚠️ The Turning Point: When the Problems Began to Show

But reality didn’t go as smoothly as the plan. Let’s track the major shifts that followed the acquisition announcement:

1️⃣ Repeated Price Hikes

After the deal was revealed, Microsoft started increasing subscription prices several times:

- In 2023, Game Pass Ultimate went from $14.99 to $16.99 per month.

- In 2024, it rose again to about $19.99.

- By 2025, it reached $29.99 with new tiers and structure changes.

These consistent price increases raised big questions: Is Microsoft trying to cover the massive Activision costs? And is this damaging user trust and loyalty?

2️⃣ Decline in Individual Game Sales

Several reports indicated that adding Call of Duty to Game Pass significantly reduced its traditional sales, causing large losses in direct revenue. Microsoft traded short-term profits for subscriber growth, but the result was lower overall game sales.

3️⃣ Fewer Exclusives and a Policy Shift

After the acquisition, Microsoft began moving away from the “full exclusivity” concept. Some of its studio titles launched on PlayStation and Switch, which weakened Xbox’s image as a unique, exclusive-focused platform.

4️⃣ Declining Trust and Doubts About the Next Generation

With rising prices and fewer exclusives, players started asking: what’s the point of owning an Xbox if all the games are available elsewhere? This combination of high costs and weaker exclusivity brings back memories of the Xbox One era, which struggled compared to PlayStation’s dominance.

⚖️ Final Evaluation: Strategic Win or Major Risk?

✅ Points That Suggest the Deal Benefited Microsoft

- Adding Activision strengthened Game Pass as a dominant player in the subscription market.

- The subscription model ensures stable revenue and long-term profitability.

- Owning a massive catalog and multiple studios gives more creative and operational flexibility.

❌ Risks Indicating the Deal Might Have Been a Mistake

- Frequent price hikes damaged the trust between Microsoft and its user base.

- Individual game sales dropped due to inclusion in the subscription.

- Lack of strong exclusives weakened Xbox’s identity versus PlayStation.

- If this continues, the next Xbox generation could face a fate similar to Xbox One.

🔍 Key Factors to Watch for the Future

- Actual subscriber numbers: Will they keep growing despite the price increases?

- Subscription revenue vs. game sales: Can Game Pass profits offset the losses?

- Exclusive roadmap: Can Microsoft deliver powerful exclusives in upcoming years?

- Community reaction: Will gamers start trusting Xbox again?

- Service sustainability: Is the Game Pass model financially viable in the long run?

🎯 Conclusion

The Activision deal was one of the biggest in gaming history, but also one of the most controversial. Yes, it gave Microsoft massive strength and an impressive library, but it also brought huge financial and strategic challenges. The ongoing price hikes and declining exclusives could threaten Xbox’s position against PlayStation, making the next generation’s success uncertain.

The deal was a bold bet — but whether it pays off or backfires, only time will tell.

Join the Conversation in Our App!

Comments are now exclusively available in our Magazine app. Get the best experience with real-time discussions, exclusive content, and personalized features.

Download Magazine App